your journey

SAP S/4HANA 1511

It’s been a long time coming. The last time the SAP ecosystem saw a similar event was R/3’s introduction more than 20 years ago. Upon release, R/3 changed the ERP landscape forever, launching SAP’s preeminence atop the enterprise software category. As expected, there are some similarities between the occasions, most especially that once again SAP completely rewrites its market-leading software to the benefit of its customers.

As we saw this past spring, when SAP debuted Simple Finance, the re-creation began with the core processes of ERP—finance and accounting. Now with the announcement of SAP S/4HANA Release 1511, customers will discover a complete ERP system beginning to emerge.

Make no mistake: With an undertaking of this size, the complete re-creation of ERP is not what Release 1511 gives to us. (There are approximately hundreds of million lines of code in ECC 6.) That overhaul will take a while to completely update the entire system, especially since SAP is not just modifying the software to work with the SAP HANA database, but also sun-setting the tired SAP user interface in favour of the SAP Fiori UX.

More Than Just the Code

Release 1511 comes with changes beyond the code. There are plenty of new names. For instance, what was called SAP Simple Finance is now renamed SAP S/4HANA Finance. You may have heard about the impending “Simple Logistics” launch, but that has been completely replaced.

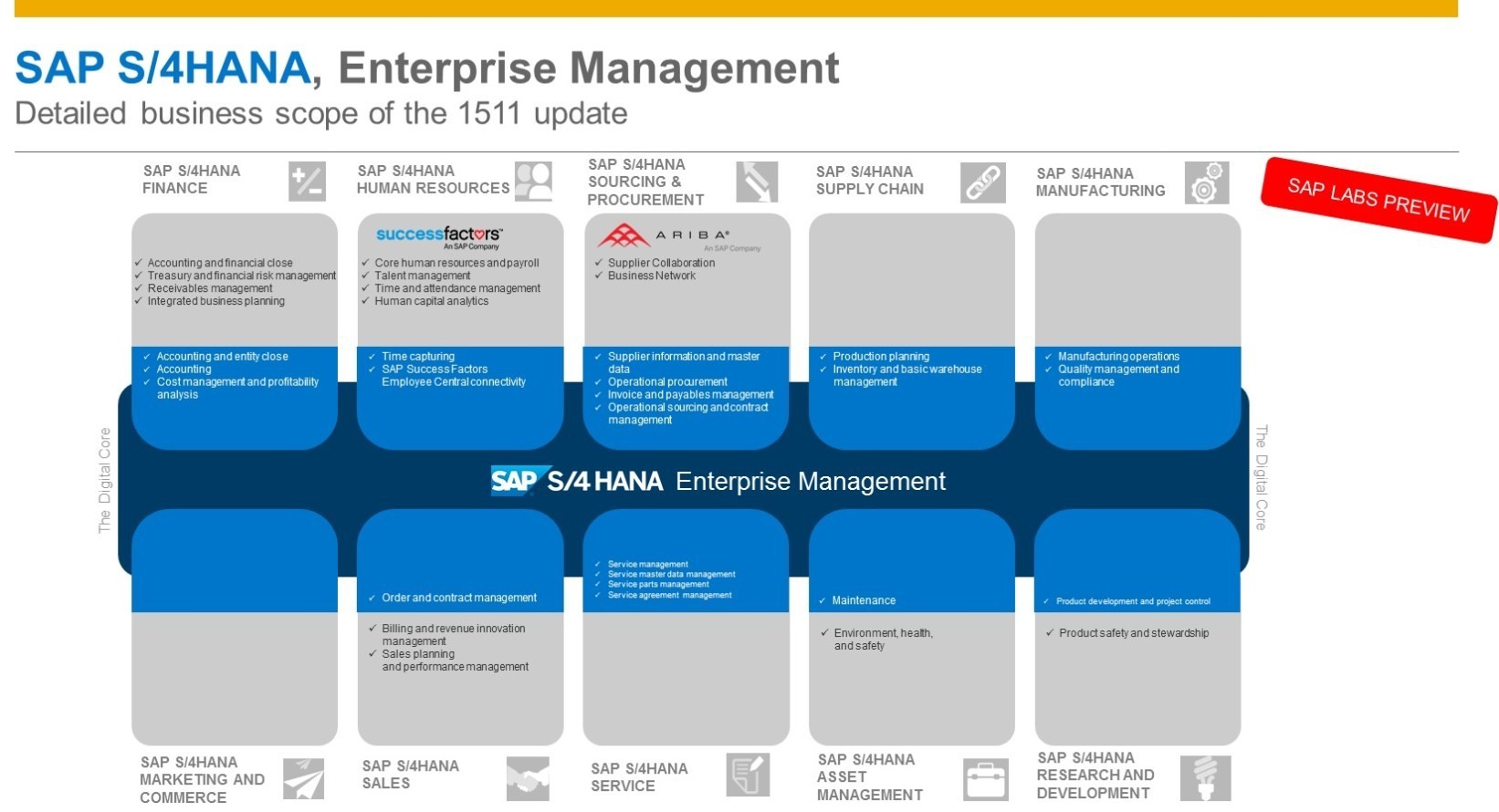

The overarching name for the new ERP is SAP S/4HANA Enterprise Management, which includes S/4HANA Finance, but also: S/4HANA Human Resources, S/4HANA Manufacturing, S/4HANA Supply Chain, S/4HANA Sourcing and Procurement, S/4HANA Marketing, S/4HANA Sales, S/4HANA Service, S/4HANA Asset Management, and S/4HANA Research & Development.

If your head is spinning a bit, let me put this in terms familiar to ECC 6.0 users. One can think of this as a redesign and relaunch of FI/CO, HCM/OM, SD, LE, PM, PP, EHS, PLM, MM, QM, LO, CS, PS, and so forth.

What Customers Can Expect

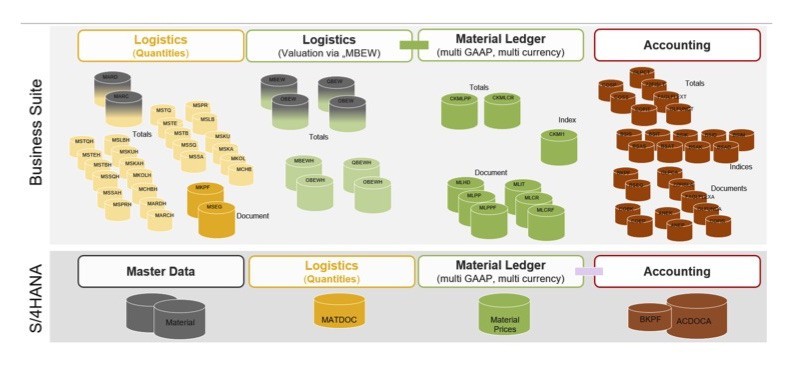

To dig deeper, we see that the table simplification begun in S/4HANA Finance has continued through several other subsystems. SAP has eliminated redundant data, such as aggregates, indexes and history, and continued the reduction of the memory footprint and table design, including clear separation of master data from transactional data.

What that means for SAP customers is more powerful, functional and easier-to-use software. Smaller database sizes lead to better performance and lower hardware cost. Improved, faster processes allow customers to take advantage of the extra time created, thereby creating value for the enterprise.

Of all the industry solutions provided in ECC, roughly three-quarters of all customers use SAP Discrete Industries and Mill Products, or DIMP, in their configuration. So S/4HANA now includes DIMP in its core code making it easier for all customers to access its functionality.

There are, to be sure, additional improvements in Release 1511. Here’s a sampling:

- Increased throughput using INSERT only

- Real-time analytics on transactional data

- A new user experience using SAP Fiori

- Major simplifications in Materials Resource Planning (MRP), Inventory Management, Capacity Planning, Sales & Distribution, and Procurement

- PP/DS side-by-side with S/4HANA

- Increased throughput of standard price utilising Material Ledger

- Extended S/4HANA material number

The Name Game: Let’s Talk Enterprise Management

Perhaps the best way to think about SAP S/4HANA Enterprise Management is this: It’s the start of the full realisation of what a Business Suite birthed on HANA will really look like and be capable of.

Previously, S/4HANA focused on what the financials piece of Business Suite would be like on HANA. S/4HANA Enterprise Management addresses functionality beyond financials, mostly in the area that SAP internally likes to call logistics, such as inventory management and production planning, though SAP promises that there’s much more to come.

Now that the S/4HANA release covers both financials and logistics, much of the core functionality of a traditional ERP system, SAP decided to use the term Enterprise Management. The idea is that S/4HANA can “span all lines of business and SAP systems—so finance, sales, service, marketing, commerce, procurement and sourcing, manufacturing, supply chain management,” says Uwe Grigoleit, SAP’s Global Head of Business Development for Suite on HANA and HANA Applications.

SAP was also keen to move away from its previous “Simple” product naming since that term might imply a “simple version of finance just covering the core part of finance rather than a fully-fledged finance system that’s simplified,” Grigoleit explains.

The simplification of the data model and coding enabled by the underlying HANA platform is allowing SAP to deliver a lot more functionality, he adds, such as predictive analytics for finance and for materials planning. “It really makes sense to give it a new brand,” he adds.

The Big Picture

If you look at the SAP graphic below, you’ll see the blue outlined box represents what’s in Enterprise Management—core elements of finance, HR, sourcing and procurement, supply chain, manufacturing, marketing and commerce, sales, service, asset management and research and development.

Effectively, what’s going on, Grigoleit says, is the reintegrating of capabilities of products that, previously, due to the limitations and constraints of the database architecture for R/3, couldn’t be included within Business Suite. In turn, they were built out as additional complementary solutions.

“What we’re starting with Enterprise Management, we will continue with the next releases, so more core capabilities of Supply Chain Management will be redeployed and integrated into S/4HANA,” he says. The same will be true for SRM (Supplier Relationship Management), where some elements like core contract management are being integrated into S/4HANA Enterprise Management.

“Our goal is to take back more of SCM, SRM, CRM and BW into one central component to completely simplify the landscape for our customers,” Grigoleit says. “It will take some time for us to be completely done, but we’re starting to deliver re-integrations across other components.”

S/4HANA will be both a loosely coupled and a hybrid suite with integrations to the Lines-of-Business (LoB) solutions. Those include members of SAP’s on-premise and cloud product portfolio—that functionality provided by Ariba, Concur, Fieldglass, Hybris and SuccessFactors, which may be available in more than one deployments or purely in the cloud (see chart below).

SAP plans to release project system, quality management and sales and distribution functionality in 2016, Grigoleit says. “We’ll continue to simplify solutions and data models and make them ready to run on HANA,” he adds. “Next, we can deliver innovations with new capabilities on those solutions.”

Cloud vs. On-Premise vs. Managed Cloud

SAP is still offering three deployment flavours for S/4HANA, but the two major options are on-premise or public cloud, Grigoleit says.

“The managed cloud type of deployment with HANA Enterprise Cloud is also possible for S/4HANA,” he adds. “Most of our [Business Suite] customers are on-premise and most are likely to go to the cloud. Managed cloud could be the perfect bridge technology to move with all their current complexity, processes and add-ons and then use services from SAP to reduce complexity and go back to simplicity and then be ready with their systems and processes to move into a public cloud scenario.”

As SAP announced during its Q3 2015 earnings call, the current promotion has been extended through Dec. 31, 2015, but there are no plans to extend it further than the end of this year, Grigoleit said.

“This is the final extension for that promotion. We’d given customers nearly three quarters, but, even so, it was still not enough time for a lot of customers to take advantage of the promo, and Q4 is a classical buying quarter,” he adds. The license promotion allows customers who have licensed HANA platform for Business Suite to upgrade to S/4HANA licenses at no charge.

Who Are the S/4HANA Early Adopters?

S/4HANA is SAP’s fastest growing product to date, with more than 1,300 customers since its launch in February. So, just who are these early adopters?

“The nice thing about them is that we’re not seeing a lot of trends,” Grigoleit says. “They’re in roughly 80 countries and across all 26 industries we support.” Some verticals are adopting S/4HANA at a faster rate than others, such as consumer products companies. Other sectors, such as financial services, which have yet to be fully impacted by digitisation, are moving more slowly, SAP says.

“We’re seeing all types of organisation moving to S/4HANA,” he adds. “We’re finalising a reference with a very small customer with only 30 employees. For small companies, they see the benefits of S/4HANA’s predefined scenarios.” Grigoleit estimates that the vast majority, more than 70 percent of new SAP customers, are moving to S/4HANA and not heavily considering any other SAP option.

Partners have been crucial to SAP’s early success with S/4HANA, Grigoleit says. SAP estimates there are now more than 2,000 resellers selling S/4HANA, and SAP partners manage more than 80 percent of all S/4HANA-focused projects.

“The partner network has been very important,” he says. “We’ve invested a lot of time and effort into the partner ecosystem. It’s very important for our customers, wherever they are, that they will find partners that are enabled on S/4HANA.”

SAP will likely roll out additional tools to help customers make the business case for and then migrate to S/4HANA to join the likes of the S/4HANA SAP Business Scenario Recommendations (BSR) report and the SAP Activate implementation framework, Grigoleit says. There may be tools to analyse the old coding of customers to identify how they can optimise that coding to apply the same techniques and routines that SAP has applied in its move to S/4HANA, he adds.

Share this:

Neil ran his first SAP transformation programme in his early twenties. He spent the next 21 years working both client side and for various consultancies running numerous SAP programmes. After successfully completing over 15 full lifecycles he took a senior leadership/board position and his work moved onto creating the same success for others.